TradingView Watchlists Explained: How to Organize and Track Your Favorite Assets

As a beginner trader, keeping track of multiple assets can quickly become overwhelming. TradingView's watchlist feature is your solution to staying organized and monitoring market movements efficiently. This comprehensive guide will walk you through everything you need to know about creating, managing, and optimizing your watchlists.

What Are Watchlists and Why Do You Need Them?

A watchlist is essentially your personalized dashboard of financial instruments you want to monitor. Instead of searching for the same stocks, cryptocurrencies, or forex pairs repeatedly, you can add them to a watchlist for instant access. Think of it as creating a favorites list for your most important trading assets.

For beginner traders, watchlists serve several critical purposes. They help you focus on specific markets without getting distracted by thousands of available instruments. They allow you to quickly compare performance across multiple assets at a glance. Most importantly, they save you valuable time during your trading day by keeping everything you need in one organized location.

Pro Tip:Start with one or two watchlists as a beginner. Create a "Learning List" with 5-10 assets you want to study closely. This focused approach helps you understand market behavior without feeling overwhelmed.

Creating Your First Watchlist: Step-by-Step Guide

Creating a watchlist on TradingView is straightforward, but knowing the right approach makes all the difference. Let's walk through the process from start to finish.

Accessing the Watchlist Panel

When you open TradingView, look for the watchlist panel on the right side of your screen. If you don't see it, click on the "Watchlist" button in the top toolbar. The default watchlist usually contains popular stocks or indices, but you'll want to customize this to match your trading interests.

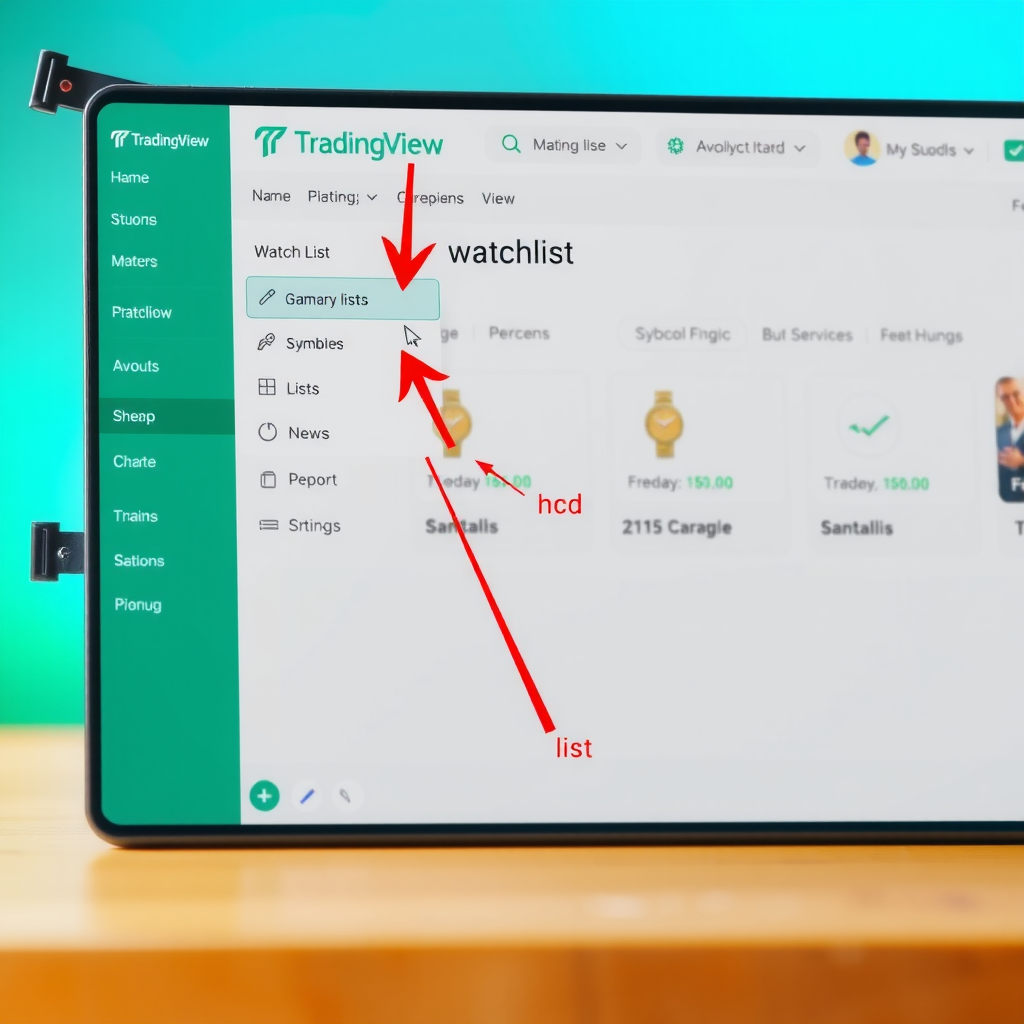

Creating a New List

To create a new watchlist, click on the three-dot menu icon at the top of the watchlist panel. Select "Create new list" from the dropdown menu. You'll be prompted to name your list – choose something descriptive that reflects its purpose. For example, "Tech Stocks," "Crypto Portfolio," or "Daily Movers."

The naming convention matters more than you might think. As you create multiple watchlists, clear names help you navigate quickly. Avoid generic names like "List 1" or "Watchlist A." Instead, use specific categories that make sense for your trading strategy.

Adding Symbols to Your Watchlist

Once your watchlist is created, it's time to populate it with assets. Click the plus icon (+) at the top of your watchlist panel. This opens the symbol search box where you can type the ticker symbol or name of any asset. TradingView will show you matching results as you type.

When adding symbols, pay attention to the exchange information. Many stocks trade on multiple exchanges, and you want to ensure you're tracking the correct one. For example, if you're interested in Apple stock, you'll see AAPL listed for NASDAQ. Click on the correct symbol to add it to your active watchlist.

Important Note:You can add up to 100 symbols per watchlist on the free TradingView plan. Premium plans offer unlimited symbols. Start with your most important assets and expand as needed.

Organizing Multiple Watchlists Effectively

As you become more comfortable with TradingView, you'll likely want to create multiple watchlists for different purposes. The key to success is thoughtful organization from the start.

Strategic Watchlist Categories

Consider creating watchlists based on different criteria. A "Market Sectors" approach might include separate lists for technology, healthcare, energy, and financial stocks. An "Investment Timeline" strategy could feature lists for day trading candidates, swing trade opportunities, and long-term holdings.

Many successful traders maintain a "Hot List" for assets showing unusual activity or breaking news. This dynamic list changes frequently and helps you stay on top of market-moving events. Pair this with a "Core Holdings" list containing assets you monitor consistently regardless of daily volatility.

Switching Between Watchlists

Navigating between multiple watchlists is simple once you know where to look. At the top of your watchlist panel, you'll see the name of your currently active list. Click on it to reveal a dropdown menu showing all your created watchlists. Select any list to switch to it instantly.

This quick-switching capability becomes invaluable during active trading sessions. You can monitor your day trading list in the morning, switch to your swing trade list during midday analysis, and review your long-term holdings in the evening – all without losing your place or reorganizing your workspace.

Customizing Watchlist Columns and Data

The default watchlist view shows basic information like price and percentage change, but TradingView offers extensive customization options to display the data most relevant to your trading style.

Adding and Removing Columns

Right-click on any column header in your watchlist to access the column customization menu. Here you can add dozens of different data points including volume, market cap, price-to-earnings ratio, 52-week high and low, average volume, and many technical indicators.

For beginners, start with essential columns: current price, change percentage, and volume. As you learn more about technical analysis, you might add columns for RSI (Relative Strength Index), moving averages, or MACD values. The beauty of TradingView is that you can see these indicators directly in your watchlist without opening individual charts.

Sorting and Filtering Options

Click on any column header to sort your watchlist by that metric. Click once for ascending order, twice for descending order. This feature is incredibly useful for quickly identifying top performers, biggest losers, or highest volume assets in your list.

Want to see which stocks in your watchlist are up more than five percent today? Sort by the change percentage column. Looking for the most actively traded assets? Sort by volume. This dynamic sorting helps you prioritize which assets deserve your immediate attention.

Success Strategy:Create a morning routine where you sort your main watchlist by percentage change. This immediately shows you which assets are making significant moves and deserve deeper analysis before the trading day begins.

Using Watchlists for Real-Time Market Monitoring

The true power of watchlists emerges when you use them for active market monitoring. TradingView updates watchlist data in real-time, making them essential tools for staying informed about market movements.

Understanding Price Updates and Color Coding

Watch your watchlist closely and you'll notice prices updating continuously during market hours. TradingView uses color coding to help you quickly identify market direction. Green indicates upward movement, red shows downward movement, and the intensity of the color often reflects the magnitude of the change.

When a price updates, you'll see a brief flash highlighting the change. This visual feedback helps you catch significant moves even when you're not actively staring at the screen. Over time, you'll develop an intuitive sense for normal market activity versus unusual movements that warrant investigation.

Clicking Through to Charts

Your watchlist serves as a launching pad for deeper analysis. Click on any symbol in your watchlist to load its chart in your main viewing area. This seamless integration between watchlist and chart view is one of TradingView's greatest strengths.

Develop a workflow where you scan your watchlist for interesting movements, click through to examine the chart, apply your technical analysis, and then return to the watchlist to continue monitoring. This efficient process allows you to cover many assets quickly without losing track of the bigger picture.

Advanced Watchlist Features for Growing Traders

As you become more experienced with TradingView, you'll discover advanced watchlist features that enhance your trading efficiency even further.

Creating Watchlist Alerts

You can set alerts directly from your watchlist without opening individual charts. Right-click on any symbol and select "Add alert." This opens the alert creation dialog where you can specify conditions like price crossing a certain level, volume exceeding a threshold, or technical indicators reaching specific values.

Watchlist-based alerts are particularly useful for monitoring multiple assets simultaneously. Instead of watching screens all day, set alerts for key price levels across your entire watchlist. TradingView will notify you when conditions are met, allowing you to focus on analysis rather than constant monitoring.

Importing and Exporting Watchlists

TradingView allows you to export your watchlists as text files and import lists from external sources. This feature is valuable when you want to share watchlists with other traders, backup your lists, or quickly populate a new watchlist with symbols from a spreadsheet or research report.

To export a watchlist, click the three-dot menu and select "Export list." The exported file contains all symbols in your list, which you can then edit in any text editor. To import, select "Import list" and choose your file. Each symbol should be on a separate line, and TradingView will automatically add them to your watchlist.

Syncing Across Devices

One of TradingView's most convenient features is automatic watchlist syncing across all your devices. Create a watchlist on your desktop computer, and it immediately appears on your mobile app and any other device where you're logged in. This seamless synchronization ensures you always have access to your organized asset lists, whether you're at your trading desk or checking markets on the go.

Common Watchlist Mistakes to Avoid

Even with a powerful tool like TradingView watchlists, beginners often make mistakes that reduce their effectiveness. Learning to avoid these pitfalls will help you get the most from your watchlists.

Overcrowding Your Watchlists

The most common mistake is adding too many symbols to a single watchlist. When your list contains 50 or 100 assets, it becomes difficult to monitor effectively. You'll spend more time scrolling than analyzing, defeating the purpose of having a focused watchlist.

Instead, keep individual watchlists lean and purposeful. A good rule of thumb for beginners is 10-20 symbols per list. If you need to track more assets, create additional categorized watchlists rather than cramming everything into one massive list.

Neglecting Regular Maintenance

Watchlists require regular maintenance to remain useful. Assets that were relevant last month might not deserve your attention today. Market conditions change, trading strategies evolve, and your watchlists should reflect these shifts.

Schedule a weekly review of your watchlists. Remove symbols that no longer fit your criteria, add new opportunities you've discovered, and reorganize lists as needed. This ongoing maintenance ensures your watchlists remain powerful tools rather than cluttered archives of past interests.

Ignoring Watchlist Customization

Many beginners stick with the default watchlist columns and never explore customization options. This means missing out on valuable data that could inform better trading decisions. Take time to experiment with different column configurations until you find a setup that matches your analysis style.

Warning:Don't confuse a watchlist with a trading plan. Just because an asset is on your watchlist doesn't mean you should trade it. Use watchlists for monitoring and research, but always apply your full analysis process before executing trades.

Practical Watchlist Strategies for Different Trading Styles

Your watchlist organization should reflect your trading style and goals. Here are proven strategies for different types of traders.

Day Trading Watchlist Setup

Day traders need watchlists optimized for quick decision-making and high-frequency monitoring. Create a primary list with 5-10 highly liquid assets that show consistent intraday volatility. Add columns for volume, average volume, and percentage change to quickly identify unusual activity.

Consider maintaining a separate "Pre-Market Movers" watchlist that you populate each morning with stocks showing significant pre-market activity. This focused approach helps you identify potential day trading opportunities before the market opens.

Swing Trading Watchlist Organization

Swing traders benefit from watchlists organized by setup type or technical pattern. Create lists like "Breakout Candidates," "Support Bounces," or "Trend Continuations." This organization helps you quickly review potential trades that match your preferred strategies.

Add columns showing key technical indicators relevant to swing trading, such as 20-day and 50-day moving averages, RSI, and MACD. These indicators help you assess whether assets in your watchlist are approaching optimal entry points.

Long-Term Investment Watchlist Approach

Long-term investors should organize watchlists by sector, market cap, or investment theme. Create lists for different portfolio components: "Core Holdings," "Growth Opportunities," "Dividend Stocks," and "Watchlist for Dips" (quality companies you'd like to own at better prices).

For long-term watchlists, add fundamental data columns like P/E ratio, dividend yield, market cap, and earnings date. These metrics help you evaluate investment quality and identify buying opportunities when prices become attractive.

Integrating Watchlists Into Your Daily Trading Routine

The most successful traders integrate watchlists seamlessly into their daily routines. Here's how to make watchlists a cornerstone of your trading process.

Morning Market Scan

Start each trading day with a systematic watchlist review. Open your primary watchlist and sort by percentage change to see which assets are making significant moves. Check your "Hot List" for any overnight news or events affecting your monitored assets. This morning scan takes just 10-15 minutes but provides crucial context for the trading day ahead.

During your morning scan, make notes about assets showing unusual behavior. Did a stock gap up on earnings? Is a cryptocurrency breaking out of a consolidation pattern? These observations help you prioritize which charts to analyze in detail and which potential trades to prepare.

Midday Check-In

Set aside time around midday to review your watchlists again. Market dynamics often shift after the opening rush, and new opportunities emerge. Sort your watchlist by volume to identify assets experiencing unusual trading activity. This midday review helps you stay connected to market flow without constant monitoring.

End-of-Day Review and Planning

After market close, use your watchlists for reflection and planning. Review how assets on your watchlist performed throughout the day. Update your lists by removing symbols that no longer meet your criteria and adding new opportunities discovered during your analysis.

This end-of-day routine also helps you prepare for the next trading session. Identify assets approaching key technical levels, note upcoming earnings announcements, and set alerts for overnight price movements. This preparation ensures you start the next day with a clear action plan.

Troubleshooting Common Watchlist Issues

Even experienced traders occasionally encounter watchlist problems. Here's how to solve the most common issues.

Watchlist Not Updating

If your watchlist prices aren't updating in real-time, first check your internet connection. TradingView requires a stable connection for live data. If your connection is fine, try refreshing your browser or restarting the TradingView app. Sometimes clearing your browser cache resolves persistent update issues.

Missing Symbols or Lists

If symbols or entire watchlists disappear, ensure you're logged into the correct TradingView account. Watchlists are account-specific and won't appear if you're logged out or using a different account. If you're certain you're in the right account and lists are still missing, contact TradingView support – they can often recover lost data.

Delayed Data Display

Free TradingView accounts receive delayed data for some markets, typically 15-20 minutes behind real-time. If you notice your watchlist showing old prices, this is likely the cause. Consider upgrading to a paid plan for real-time data access, especially if you're actively trading based on watchlist information.

Taking Your Watchlist Skills to the Next Level

Mastering watchlists is an ongoing journey. As you gain experience, you'll develop personalized systems that perfectly match your trading style and goals.

Start by implementing the basics covered in this guide: create focused watchlists, customize columns to show relevant data, and integrate watchlist reviews into your daily routine. As these practices become habitual, experiment with advanced features like custom columns, complex sorting strategies, and watchlist-based alert systems.

Remember that effective watchlist management is about quality over quantity. A well-organized watchlist with 15 carefully selected assets will serve you better than a cluttered list of 100 random symbols. Focus on assets you understand, markets you follow closely, and opportunities that align with your trading strategy.

The time you invest in learning watchlist features pays dividends throughout your trading career. These organizational tools help you stay focused, make faster decisions, and avoid the overwhelming feeling that comes from trying to monitor too many assets simultaneously. Master your watchlists, and you'll master a crucial component of successful trading on TradingView.

Ready to Organize Your Trading?

Now that you understand how to create and manage watchlists effectively, it's time to put this knowledge into practice. Start with one focused watchlist today, and gradually build your organizational system as you become more comfortable with TradingView's features.

Continue exploring our TradingView tutorials to learn more about chart analysis, technical indicators, and trading strategies that complement your watchlist skills.