Setting Up Price Alerts on TradingView: Never Miss Important Market Moves

Learn how to configure price alerts and notifications on TradingView so you can stay informed about market changes without constantly watching your screen. Includes tips for mobile and desktop alert management.

One of the most powerful features of TradingView is its comprehensive alert system. Price alerts allow you to monitor market movements without being glued to your screen all day. Whether you're a day trader, swing trader, or long-term investor, mastering TradingView's alert functionality will significantly improve your trading efficiency and help you catch important opportunities.

Why Price Alerts Are Essential for Traders

Before diving into the technical setup, it's important to understand why price alerts are crucial for your trading success. Constantly monitoring charts is mentally exhausting and practically impossible if you're tracking multiple assets or have other commitments. Price alerts solve this problem by notifying you when specific conditions are met, allowing you to focus on analysis and execution rather than constant surveillance.

Professional traders use alerts to catch breakouts, monitor support and resistance levels, track indicator signals, and manage risk by setting stop-loss reminders. With TradingView's alert system, you can automate this monitoring process and receive notifications via email, SMS, push notifications, or even webhook integrations.

Pro Tip:Start with a few essential alerts and gradually expand your alert system as you become more comfortable with the platform. Too many alerts can lead to notification fatigue and missed opportunities.

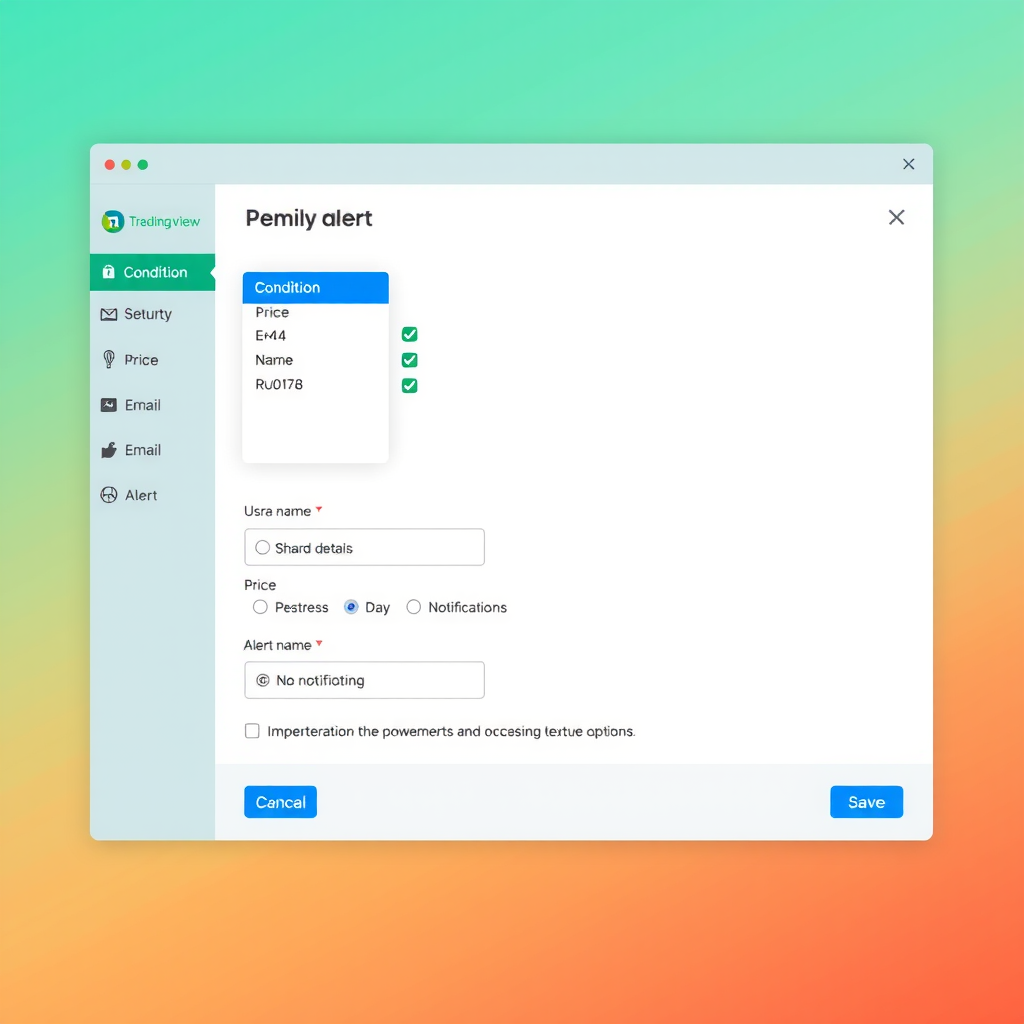

Creating Your First Price Alert

Setting up a basic price alert on TradingView is straightforward. First, open the chart for the asset you want to monitor. Right-click anywhere on the chart and select "Add Alert" from the context menu, or use the keyboard shortcut Alt+A (Windows) or Option+A (Mac). This opens the alert creation dialog where you'll configure your alert parameters.

Understanding Alert Conditions

The alert condition is the heart of your alert setup. TradingView offers several condition types that determine when your alert will trigger. The most common condition is "Crossing" which triggers when the price crosses a specific level. You can set it to trigger when price crosses up, crosses down, or crosses in either direction.

Other useful conditions include "Greater Than" for breakout alerts, "Less Than" for breakdown alerts, "Entering Channel" for range-bound trading, and "Exiting Channel" for breakout confirmation. For more advanced setups, you can create alerts based on indicator values, such as when RSI crosses above 70 or when MACD crosses its signal line.

Setting the Alert Price Level

After selecting your condition, you'll need to specify the price level that will trigger the alert. You can either type in a specific price or click and drag a horizontal line on your chart to visually set the alert level. The visual method is particularly useful when setting alerts at support and resistance levels or chart patterns.

When setting alert levels, consider using round numbers or significant technical levels. These psychological price points often see increased trading activity and are more likely to produce meaningful price action. For example, setting an alert at $50.00 rather than $49.87 might be more strategic depending on your trading approach.

Configuring Notification Methods

TradingView offers multiple notification methods to ensure you never miss an important alert. The notification options section allows you to choose how you want to be informed when your alert triggers. Each method has its advantages depending on your trading style and availability.

Push Notifications

Push notifications are the most immediate way to receive alerts. They appear on your mobile device or desktop browser even when TradingView isn't open. To enable push notifications, you'll need to install the TradingView mobile app and ensure notifications are enabled in your device settings. Push notifications are ideal for time-sensitive alerts where immediate action might be required.

Email Notifications

Email notifications provide a permanent record of your alerts and are useful for less urgent situations. They're particularly valuable for swing traders or position traders who don't need instant notifications. Email alerts also allow you to set up automated workflows using email filters and rules, potentially integrating with other tools in your trading system.

SMS Notifications

SMS notifications are available for Premium and Pro+ subscribers and provide the most reliable delivery method. Text messages don't require an internet connection to receive and are less likely to be missed than app notifications. However, be mindful of SMS alert frequency to avoid overwhelming yourself with messages during volatile market conditions.

Important Note:Different TradingView subscription tiers have different alert limits. Free accounts can create a limited number of alerts, while paid subscriptions offer more alerts and additional notification methods. Check your plan's alert quota to avoid hitting limits during critical trading periods.

Advanced Alert Strategies

Once you're comfortable with basic price alerts, you can explore more sophisticated alert strategies that combine multiple conditions and indicators. These advanced techniques help filter out noise and focus on high-probability trading opportunities.

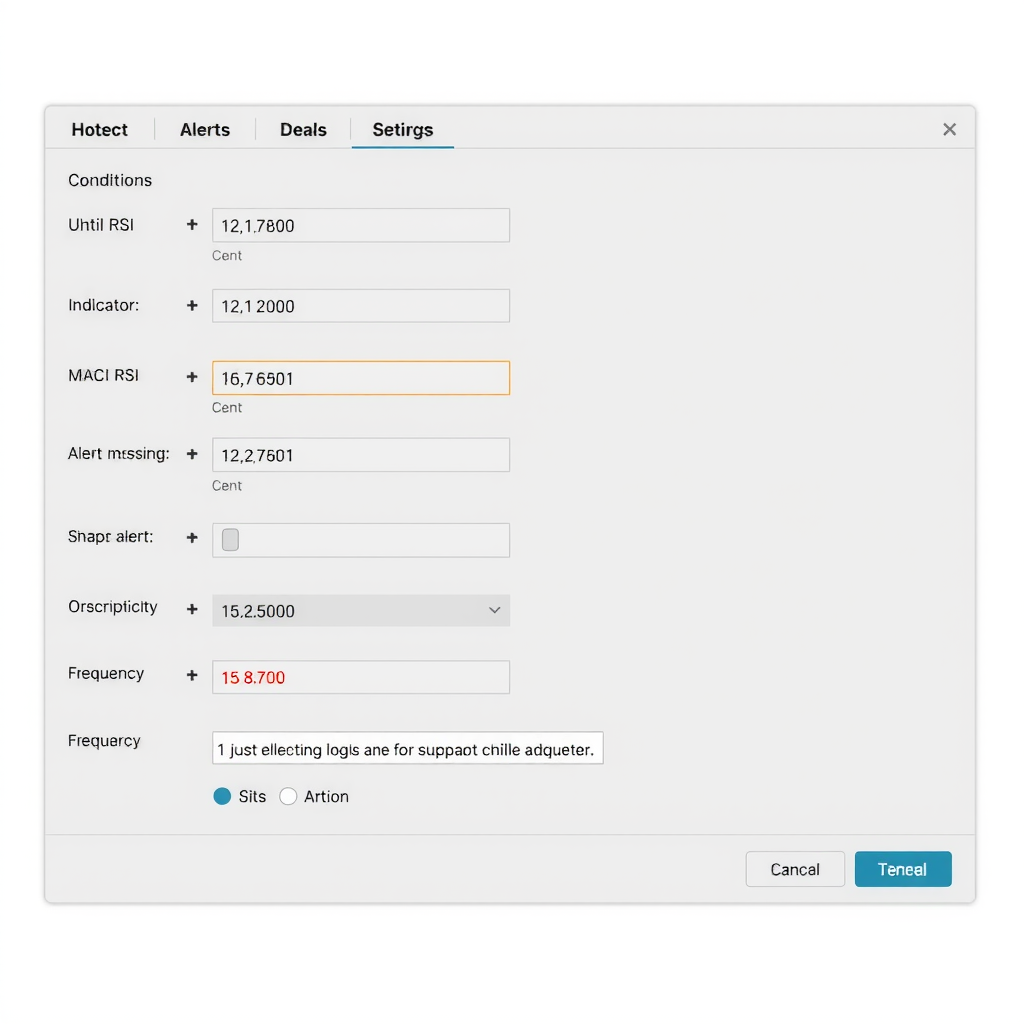

Indicator-Based Alerts

Indicator-based alerts trigger when specific technical indicator conditions are met. For example, you can create an alert when the RSI crosses above 70 (overbought) or below 30 (oversold). Moving average crossovers are another popular indicator alert, such as when a fast moving average crosses above a slow moving average, potentially signaling a trend change.

To create an indicator alert, first add the indicator to your chart, then click the three dots next to the indicator name and select "Add Alert on [Indicator Name]". This opens the alert dialog with the indicator already selected as the condition source. You can then specify the exact condition you want to monitor, such as crossing a specific value or crossing another indicator line.

Multi-Timeframe Alerts

Multi-timeframe analysis is crucial for confirming trading signals, and TradingView allows you to create alerts that consider multiple timeframes. While you can't directly create a single alert with multiple timeframe conditions, you can set up complementary alerts on different timeframes for the same asset. For instance, set a daily timeframe alert for major trend changes and a 4-hour alert for entry timing.

Custom Alert Messages

Customizing your alert messages makes them more actionable and informative. Instead of receiving a generic "Price crossed $50" notification, you can create detailed messages that include the asset name, current price, percentage change, and even your planned action. Use TradingView's placeholder variables like {{ticker}}, {{close}}, and {{volume}} to automatically populate current market data in your alert messages.

A well-crafted alert message might read: "BTCUSD crossed above $50,000 resistance. Current price: {{close}}. Volume: {{volume}}. Consider long entry with stop at $49,500." This level of detail helps you make faster decisions when the alert triggers, especially if you're managing multiple positions across different assets.

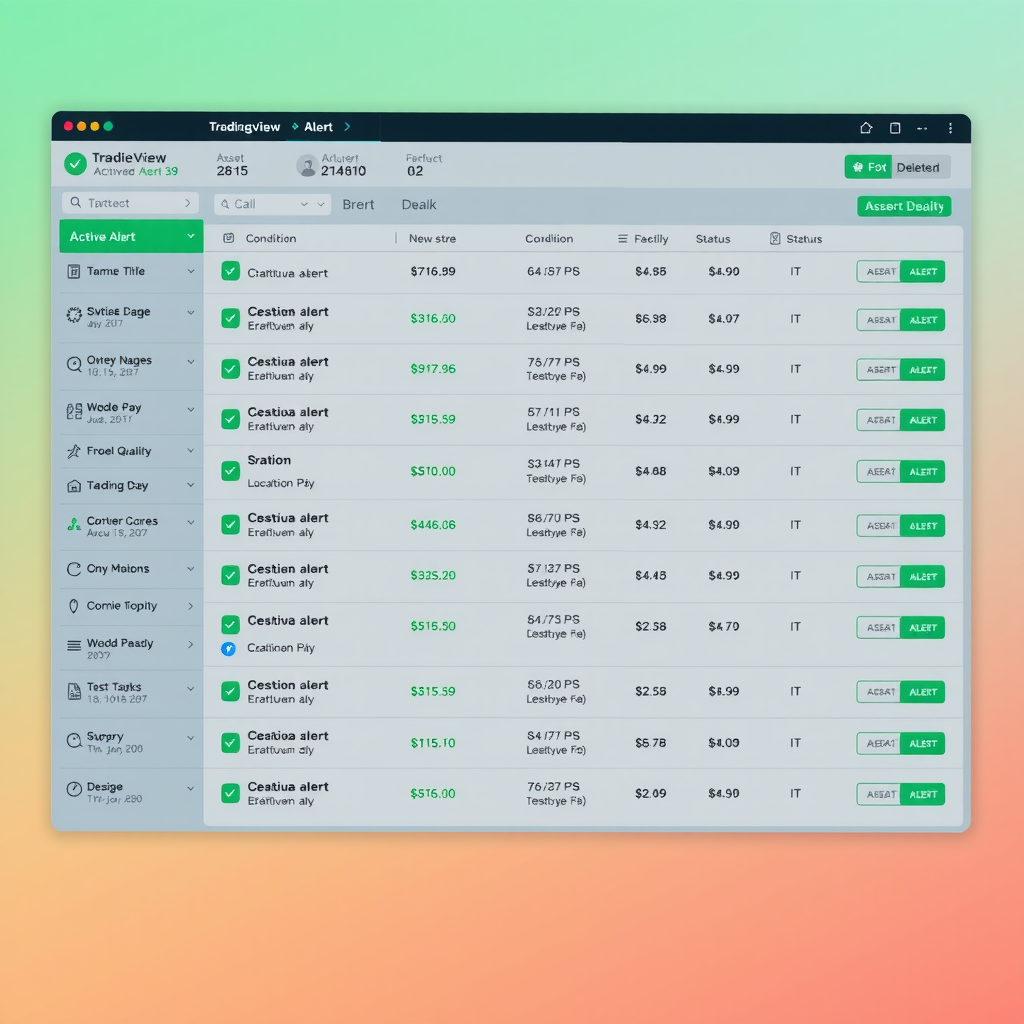

Managing Your Alert List

As you create more alerts, organization becomes essential. TradingView provides an alert management panel where you can view, edit, and delete all your active alerts. Access this panel by clicking the alarm clock icon in the right sidebar or by pressing Alt+A and then clicking "Manage Alerts."

Alert Naming Conventions

Develop a consistent naming system for your alerts to quickly identify their purpose. Include the asset symbol, timeframe, condition type, and price level in the alert name. For example: "BTCUSD-4H-Breakout-52000" immediately tells you this is a Bitcoin 4-hour chart breakout alert at $52,000. This systematic approach becomes invaluable when managing dozens of alerts across multiple assets.

Alert Expiration Settings

TradingView allows you to set expiration dates for your alerts, which is useful for time-sensitive trading setups. If you're watching for a breakout that you expect within the next week, set the alert to expire after that period. This prevents outdated alerts from cluttering your alert list and potentially triggering when the market context has changed significantly.

You can also choose whether an alert should trigger only once or repeatedly. One-time alerts are ideal for specific entry or exit points, while repeating alerts work well for monitoring ongoing conditions like staying above a moving average or maintaining within a price range.

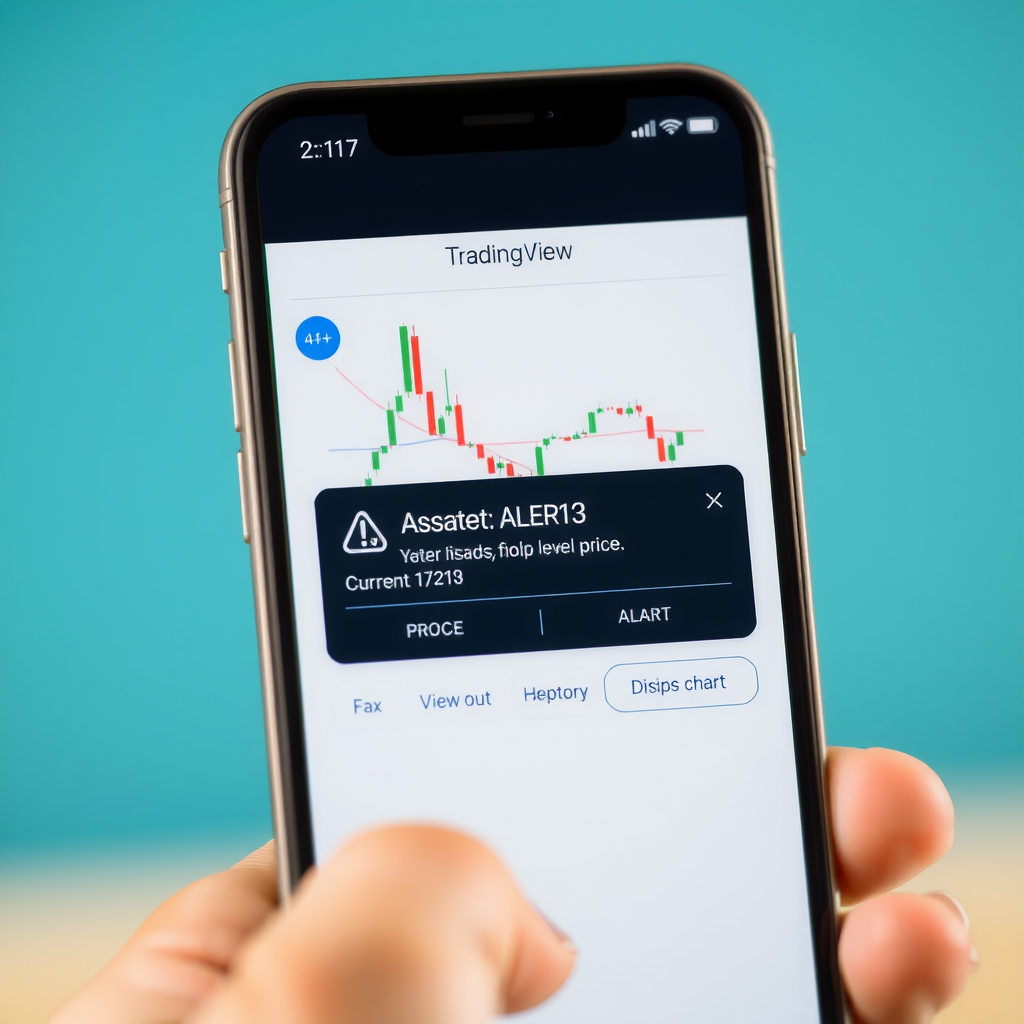

Mobile Alert Management

The TradingView mobile app provides full alert functionality, allowing you to create, edit, and manage alerts on the go. The mobile interface is optimized for quick alert creation, making it easy to set up alerts while reviewing charts during your commute or away from your desktop.

Enabling Mobile Notifications

To receive push notifications on your mobile device, ensure that notifications are enabled in your device settings for the TradingView app. On iOS, go to Settings > Notifications > TradingView and enable all notification types. On Android, navigate to Settings > Apps > TradingView > Notifications and enable notifications. Also verify that your notification settings within the TradingView app itself are configured correctly.

Quick Alert Creation on Mobile

Creating alerts on mobile is streamlined for efficiency. Long-press on any price level on your chart to bring up the quick action menu, then select "Create Alert." This immediately opens the alert dialog with the price level pre-filled. You can also tap the alarm icon in the top toolbar to access the full alert creation interface with all advanced options.

Common Alert Mistakes to Avoid

Even experienced traders make mistakes when setting up alerts. Being aware of these common pitfalls will help you create more effective alert systems and avoid missed opportunities or false signals.

Setting Too Many Alerts

Alert fatigue is real. Setting alerts for every minor price level or indicator signal will overwhelm you with notifications and diminish the value of truly important alerts. Focus on key levels and high-probability setups. Quality over quantity should be your guiding principle when building your alert system.

Forgetting to Update Alerts

Market conditions change, and your alerts should change with them. Regularly review and update your alert levels based on new support and resistance zones, trend changes, or shifts in your trading strategy. Outdated alerts can trigger at irrelevant price levels, wasting your time and potentially causing confusion during fast-moving markets.

Ignoring Alert Context

An alert triggering doesn't automatically mean you should take action. Always check the broader market context, news events, and overall trend before executing a trade based on an alert. Alerts are tools for awareness, not automatic trading signals. Combine alert notifications with proper analysis and risk management before making trading decisions.

Success Strategy:Create a weekly routine to review and clean up your alert list. Remove triggered alerts that are no longer relevant, update price levels based on new technical analysis, and ensure your notification settings are optimized for your current trading schedule.

Integrating Alerts with Your Trading Workflow

The true power of TradingView alerts emerges when you integrate them into a comprehensive trading workflow. Alerts should complement your analysis process, not replace it. Develop a systematic approach to how you respond to different types of alerts based on your trading strategy and risk management rules.

For day traders, alerts might trigger immediate chart review and potential trade execution. Swing traders might use alerts to add positions to a watchlist for deeper analysis during their next trading session. Position traders could use alerts as early warning signals for potential portfolio adjustments. Tailor your alert response protocol to match your trading style and time availability.

Creating Alert Templates

If you trade similar setups across multiple assets, consider creating alert templates. While TradingView doesn't have a built-in template feature, you can standardize your alert naming, message formatting, and notification settings. This consistency makes it easier to quickly understand what each alert represents and what action it requires when it triggers.

Combining Alerts with Watchlists

Use TradingView's watchlist feature in conjunction with alerts for maximum efficiency. Create watchlists for different trading strategies or market sectors, then set up alerts for the most promising setups within each watchlist. This organizational structure helps you maintain focus and ensures you're monitoring the right opportunities at the right time.

Troubleshooting Alert Issues

Occasionally, you might encounter issues with alerts not triggering or notifications not arriving. Understanding common problems and their solutions will help you maintain a reliable alert system.

Alerts Not Triggering

If an alert doesn't trigger when you expect it to, first verify that the alert is still active in your alert list. Check that the condition is set correctly and that the price actually crossed the specified level on the timeframe you're monitoring. Remember that alerts trigger based on the close of the candle, not intraday wicks, unless you've specifically configured them otherwise.

Missing Notifications

If alerts are triggering but you're not receiving notifications, check your notification settings both in TradingView and on your device. Ensure that Do Not Disturb mode isn't blocking notifications, and verify that your email address is correct if you're using email notifications. For push notifications, confirm that the TradingView app has permission to send notifications on your device.

Conclusion: Building Your Alert System

Mastering TradingView's alert system is a journey that evolves with your trading experience. Start with simple price alerts for key support and resistance levels, then gradually incorporate more sophisticated indicator-based alerts as you develop your trading strategy. Remember that alerts are tools to enhance your trading efficiency, not replace careful analysis and sound risk management.

The key to an effective alert system is finding the right balance between staying informed and avoiding information overload. Regularly review and refine your alerts, removing those that no longer serve your trading goals and adding new ones as opportunities emerge. With practice, you'll develop an alert system that keeps you connected to the markets without requiring constant screen time, allowing you to trade more effectively and maintain better work-life balance.

Take time to experiment with different alert types, notification methods, and organizational strategies. What works for one trader might not work for another, so customize your alert system to match your unique trading style, schedule, and goals. The investment you make in setting up a robust alert system will pay dividends in improved trading performance and reduced stress from constant market monitoring.